Table of Contents

What Is Mortgage Life Insurance?

Mortgage life insurance—also called mortgage protection, creditor insurance, or mortgage payoff insurance—is a group life policy offered by banks, credit unions, and mortgage lenders. If you pass away (or, with some riders, suffer a covered disability or critical illness), the insurer pays the outstanding mortgage balance directly to the lender, protecting surviving family members from foreclosure.

Key Features:

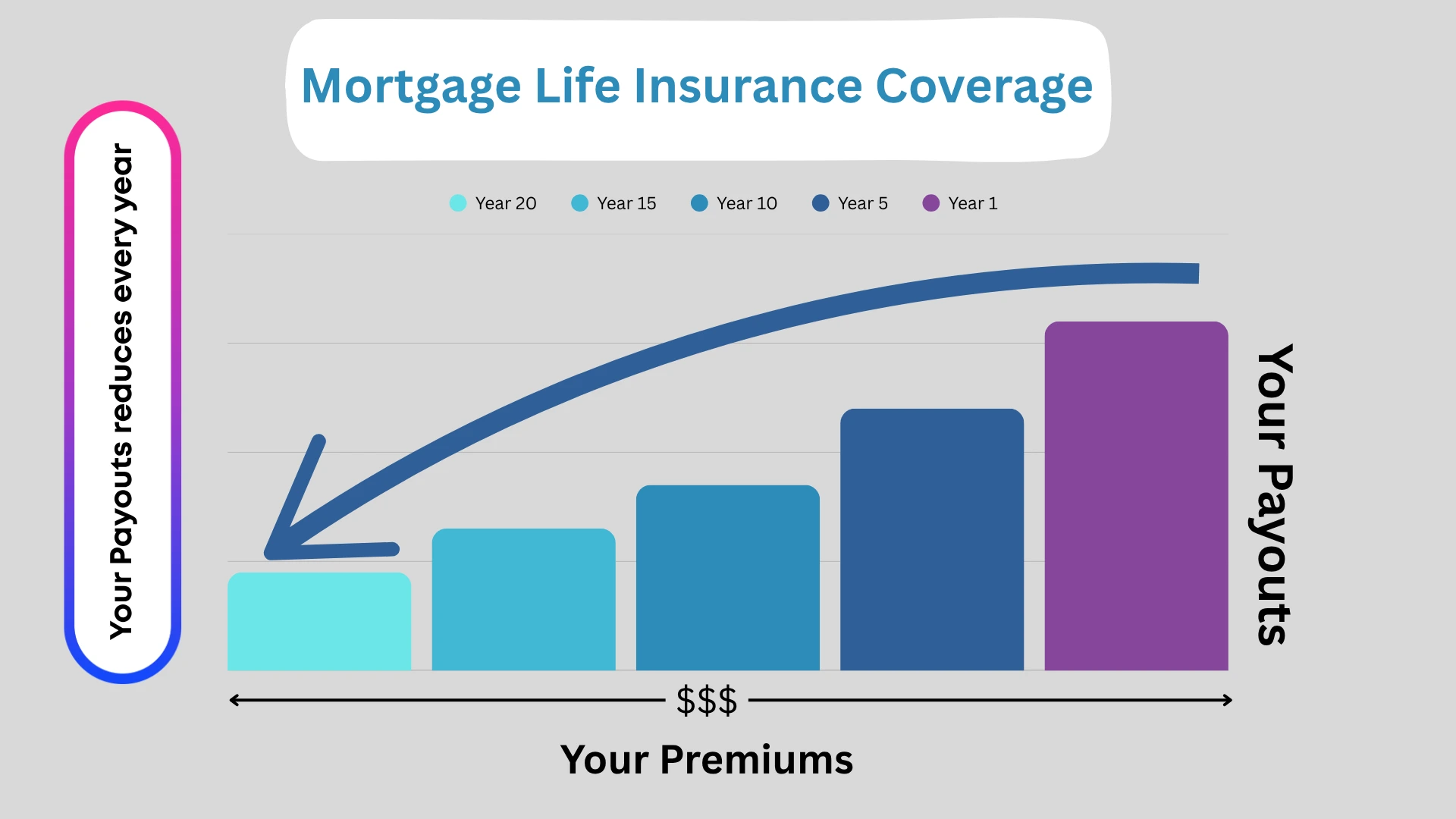

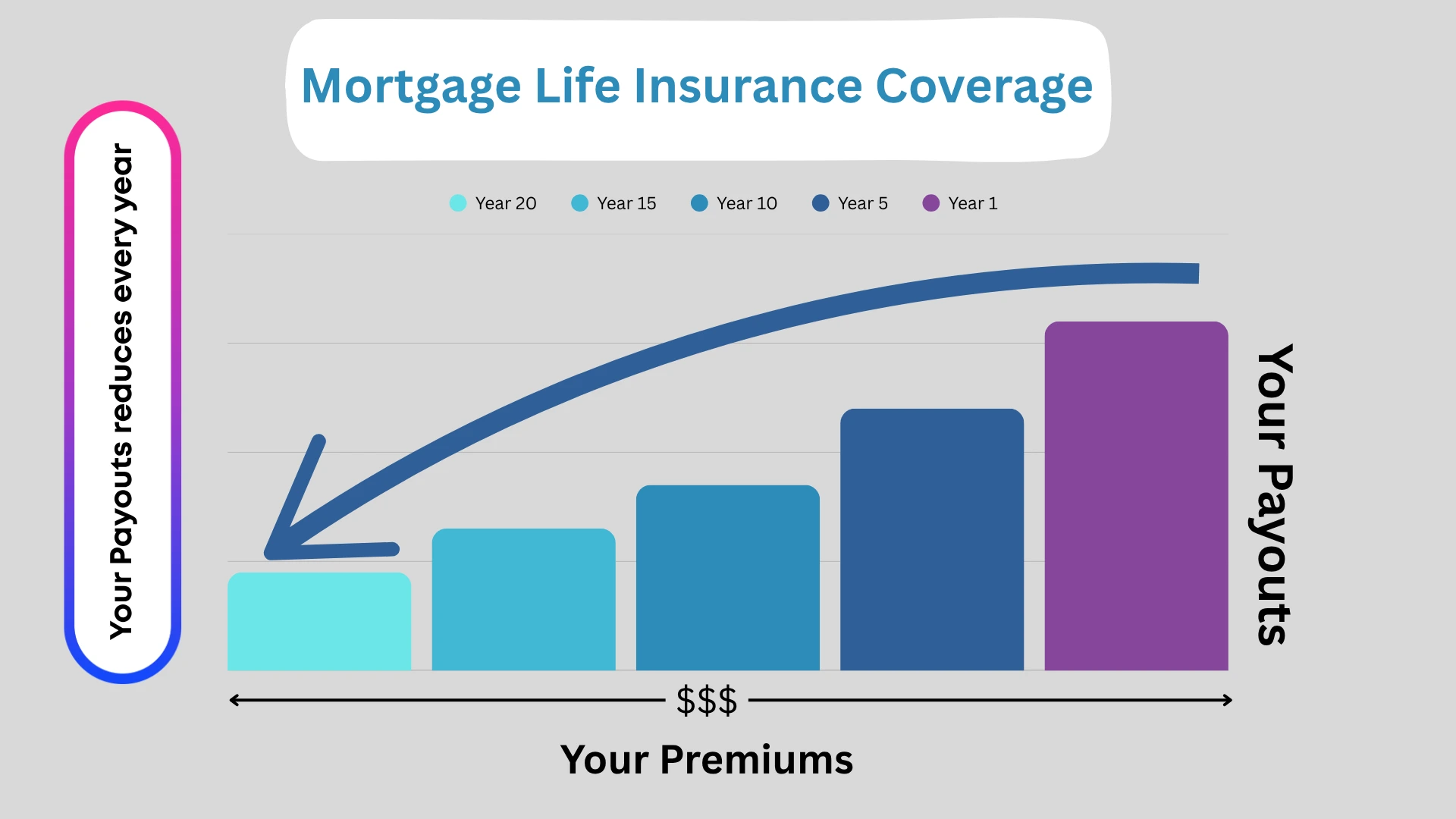

- Decreasing Benefit: Premiums remain fixed, but coverage decreases as you pay off your mortgage.

- Guaranteed Approval: Often offered without a medical exam, though some providers may require health disclosures.

- Lender-Specific: Typically purchased through your mortgage provider.

Secure Your Home & Financial Stability!

Get 24/7 expert assistance and compare quotes from top Canadian insurers

Get Free Quote Now

Available 24/7 - Quick, Easy & Hassle-Free!

Why Do Canadians Buy It?

- Peace of mind: Recent Royal LePage data show 63% of homeowners worry about their family losing the house if the main breadwinner dies.

- Convenience: Enrollment is embedded in the mortgage closing paperwork; no separate medical exam 90% of the time.

- Mandatory?: No. Lenders may recommend it, but under the Bank Act (s. 627.04) you cannot be denied a mortgage for refusing creditor insurance.

- Alternative to CMHC default insurance: Don’t confuse mortgage life coverage (protects your family) with default insurance (protects the lender if you stop paying).

How Much Does Mortgage Life Insurance Cost in Canada?

The phrase many Canadians literally ask voice assistants is:

"How much does mortgage life insurance cost in Canada in 2025?”

Answer: $0.10 – $0.55 per $1,000 of coverage per month, depending on age, mortgage size, health, smoking status, and lender.

| Age Range |

Non-Smoker |

Smoker |

Effective Annual Cost on $400k Mortgage |

| 25-34 |

$0.13 |

$0.25 |

$624 – $1,200 |

| 35-44 |

$0.19 |

$0.38 |

$912 – $1,824 |

| 45-54 |

$0.35 |

$0.50 |

$1,680 – $2,400 |

Data compiled from TD, RBC, and CIBC 2025 rate sheets; averages updated Feb-2025.

Key Factors That Influence Your Premium

- Mortgage Balance: Premiums are fixed at closing but the coverage amount decreases as you pay down principal, effectively raising your effective cost per $1,000 over time. A $500,000 mortgage will cost more than a $300,000 loan. Premiums usually range from $1 to $5 per $1,000 of coverage monthly, depending on other factors.

- Age & Health Band: Lenders group applicants in 5-year or 10-year bands; turning 35, 45, or 55 can jump rates by 20%+. Older applicants or those with pre-existing conditions face higher premiums.

- Smoking Status: Expect ≈ 70% surcharge. Smokers typically pay double non-smokers’ rates due to higher health risks.

- Joint vs. Single: Couples often share one policy that pays off the mortgage on the first death; joint coverage is usually cheaper than two singles.

- Riders: Adding disability or critical-illness benefits may tack on 30%–40%. Riders like critical illness or disability coverage add to premiums but enhance protection.

Mortgage Insurance vs. Term Life Insurance

| Feature |

Mortgage Life Insurance |

Individual Term Life Insurance |

| Beneficiary |

Lender |

Loved ones decide how to use payout |

| Coverage Amount |

Declines with mortgage balance |

Level (static) |

| Portability |

Ends if you switch lenders |

Portable |

| Underwriting |

“Post-claim” review possible |

Full underwriting upfront |

| Typical Cost |

Higher after 5–10 yrs |

Lower per $1,000 |

Industry insight: A 35-year-old non-smoker could secure a 20-year $500k term policy for $30/mo from Canada Life, vs. $76/mo in equivalent mortgage creditor premiums (TD 2025 booklet).

2025 Premium Benchmarks & Case Studies

Case Study A: First-Time Buyer, Toronto

- Mortgage: $650,000, 25-year amortization

- Age/Status: 31, female, non-smoker

- Lender quote: $0.16 / $1,000 → $104/mo

- Alternative: 25-yr, $650k term life from PolicyMe, $42/mo → Savings $744/yr

Case Study B: Refinancer, Calgary

- Mortgage: $420,000 remaining

- Age/Status: 44 & 46, couple, husband smokes

- Joint bank premium: $152/mo

- Strategy: Husband buys $500k 15-yr term life ($78/mo); wife buys $300k ($32/mo). Combined $110/mo.

- Net savings: $504/year, portable upon renewal.

Ways to Save on Mortgage Protection

- Shop independent brokers: Use comparison sites like Ratesdotca or InsuranceHotline to pull multiple quotes in less than 5 minutes.

- Bundle with term life: Insurers offer multi-policy discounts up to 10%.

- Quit smoking for 12 months: Re-classify to non-smoker tier and request a rate review.

- Re-evaluate at renewal: Switch lenders? Consider a fresh term policy instead of re-applying for creditor insurance.

- Increase deductible disability benefits1: If you add riders, higher deductibles lower premiums.

FAQ (Voice-Search Optimized)

Q1. Do I need mortgage life insurance in Canada?

No law requires it. It’s optional, though many lenders will highlight it at closing.

Q2. What happens if I switch banks?

Your creditor insurance usually ends. You’d re-apply and could face higher age-band rates.

Q3. Can my bank deny my claim after death?

Yes, if medical questions were answered inaccurately. According to the FCAC, 16% of claims were rejected in an audit conducted in 2023. Take a look at the fine print!

Q4. Is mortgage life insurance tax-deductible?

Premiums are generally not tax-deductible for personal residences.

Q5. Is term life always cheaper?

Typically, but if you have serious health issues, simplified creditor insurance may be your only affordable option.

Final Thoughts & Additional Resources

Mortgage life insurance offers hassle-free signup but often at a premium. Take the time to compare quotes, weigh the benefits of portable term life, and read policy exclusions carefully.

Helpful links:

© 2024 policybazar.ca | All rights reserved